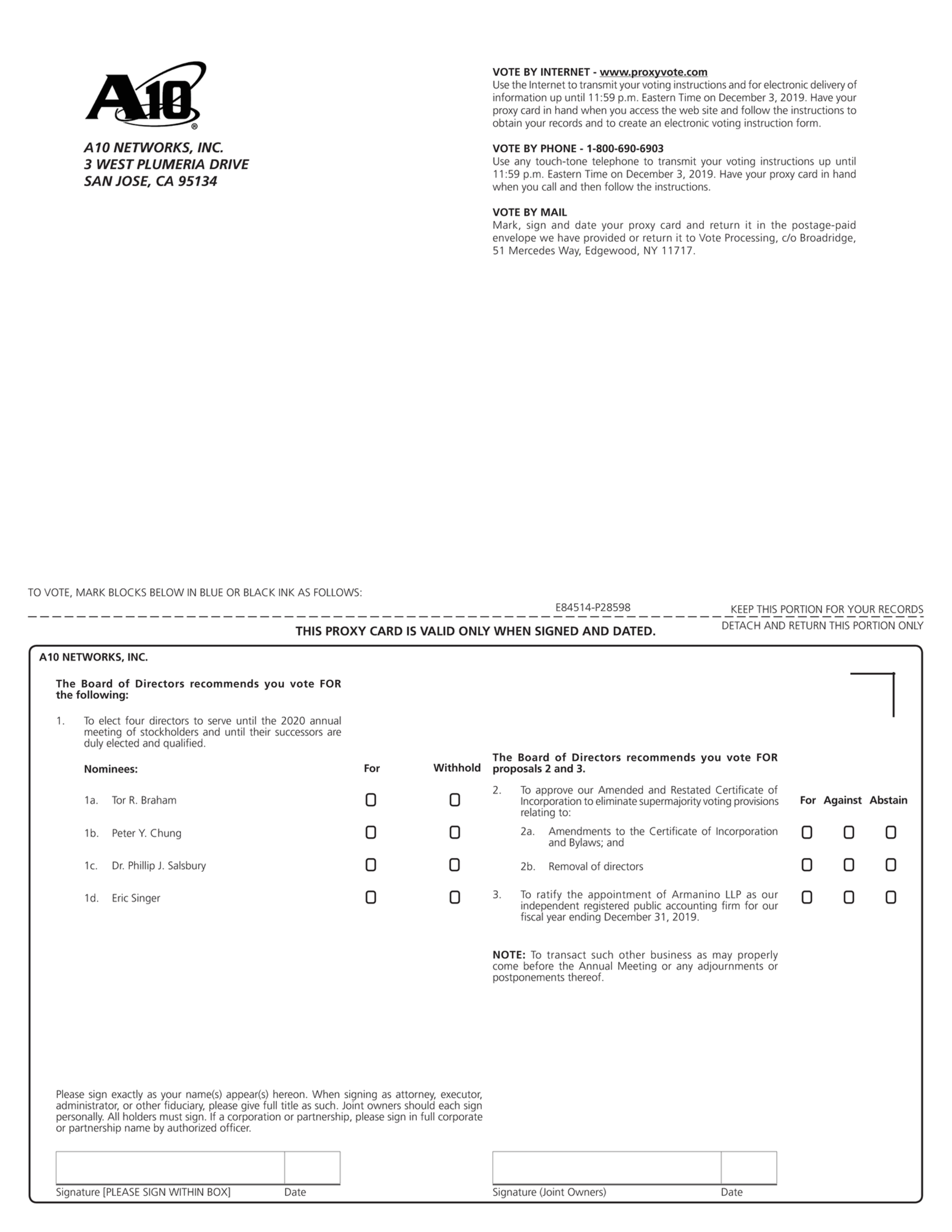

Proposal 2(b): Eliminate Supermajority Voting Provision to Remove Directors

Currently, the Certificate states that stockholders can remove a director from office only if that action is approved by at least a two-thirds supermajority vote (see Article V, Section 5.3 of the Certificate). This Proposal 2(b) proposes to amend this provision by replacing the reference to “66-2/3%” with “a majority.” As a result, if approved and (ii) increasesimplemented, stockholders would be able to remove any director from office by 4,000,000 shares the maximum numberaffirmative vote of the holders of at least a majority of the voting power of all then outstanding shares of our commoncapital stock that will be made available for saleentitled to vote on the matter, voting together as a single class, which is the default voting standard under the ESPP (collectively referred to as the “Amendment”). As such, following the effectiveness of the Amendment, any additional increasesDelaware General Corporation Law.

Related Changes to the ESPP’s share reserve in future years will require additional stockholder approval. Our compensation committee andBylaws

In connection with the Proposed Certificate Amendment, our board of directors havehas approved the Amendment, subjectconforming amendments to the Bylaws, contingent upon stockholder approval and implementation of our stockholders at the Annual Meeting.

Ourrelated portion of the Proposed Certificate Amendment. Specifically, our board of directors adopted,has approved amendments to the Bylaws to: (i) replace the two-thirds supermajority voting provision to amend the Bylaws set forth in Article X with the majority voting standard described above under Proposal 2(a) and (ii) make certain other changes as set forth therein.

Additional Information

The general description of the Proposed Certificate Amendment set forth above is qualified in its entirety by reference to the text of the Proposed Certificate Amendment, which is attached as Appendix A to these proxy materials. In addition, the text of the related and other amendments to the Bylaws, which can be amended from time to time by our stockholdersboard of directors, is attached as Appendix B to these proxy materials. Additions to the Certificate and the Bylaws are indicated by double underlining. Deletions to the Certificate and the Bylaws are indicated by strikeouts.

The Proposed Certificate Amendment is binding. If either Proposal 2(a) or Proposal 2(b) is approved, the ESPP in March 2014. Currently,Company intends to file a maximumCertificate of 2,857,971 shares of our common stock have been reserved for issuance under the ESPP, which includes the initial 1,600,000 shares that were reserved under the ESPP plus a total of 1,257,971 shares of our common stock that were addedAmendment to the ESPP pursuantCertificate with the Secretary of State of the State of Delaware, and the portion of the Proposed Certificate Amendment relating to such proposal will become effective at the Annual Share Increasestime of that occurred onfiling. If neither Proposal 2(a) nor Proposal 2(b) is approved by the first dayrequisite vote, then a Certificate of eachAmendment will not be filed with the Secretary of our fiscal years 2015State of the State of Delaware, the supermajority voting provisions in both the Certificate and 2016. BeforeBylaws will remain in place, and the Amendment,related Bylaw amendments will not become effective.

Vote Required

Under the ESPP limits each Annual Share Increase toexisting supermajority voting provisions set forth in the Certificate, the affirmative vote of the holders of at least of (i) 3,500,000 shares of our common stock, (ii) onesixty-six and two-thirds percent (1%(66-2/3%) of the voting power of all outstanding shares of our common stock on the last day of our immediately preceding fiscal year, or (iii) an amount determined by the administrator of the ESPP. As of April 1, 2016, 1,184,272 shares of our common stock remained available for issuance under the ESPP. We currently expect that approximately 590,000 shares will be purchased in our May 2016 purchase leaving approximately 594,272 shares remaining available for issuance under the ESPP.

If stockholdersis required to approve this Amendment, the number of shares of our common stock issuable under the ESPP would increase by 4,000,000, bringing the maximum number of shares of our common stock under the ESPP’s share reserve to 6,857,971, of which an aggregate of 1,673,699 shares have been issued since March 2014 through April 1, 2016. We have not made any other material amendments to the ESPP since it became effective in March 2014. Following the next scheduled purchase of shares under the ESPP in May 2016, the number of shares of our common stock remaining available for sale under the ESPP, if stockholders approve this Amendment, is expected to be approximately 4,594,272 shares.

Without stockholder approval of the Amendment, we believe our ability to use the ESPP as a tool to assist us to attractProposal 2(a) and retain the individuals necessary to drive our performance and increase long-term stockholder value will be limited. We believe that the approval of the Amendment is important to our continued success. If stockholders do not approve the Amendment, the ESPP will continue without any increase in the share reserve and the Annual Share Increases will remain in effect. In that case, it is likely that the shares reserved for issuance under the ESPP may be insufficient to cover full grants under the ESPP during fiscal year 2016 and each fiscal year thereafter while the ESPP remains in effect, and enrollments under the ESPP may need to be reduced annually to eliminate overenrollment. If the shares available for issuance under the ESPP run out, it will be more difficult for us to meet our goals of recruiting, retaining and motivating talented employees.

In approving the Amendment and recommending that our board of directors approve the Amendment, our compensation committee reviewed: (1) current and anticipated employee participation, expected levels of contribution and pricing available under the ESPP to purchase shares of our common stock, (2) the period of time the current balance would last based on the number of shares of our common stock currently available under the ESPP, (3) the historical number of shares actually purchased under the ESPP since its adoption, (4) the

percent of eligible participants who participated, (5) the expected period of time that the increased share reserve will last, (6) the percent of our common stock outstanding that the 4,000,000 share increase proposed by the Amendment would represent, which was approximately 6.2 percent, (7) the analysis and recommendations of the independent compensation consultant retained by our compensation committee, (8) key components of the ESPP design, and (9) the recommendations of management.

Description of the ESPP

The following paragraphs provide a summary of the principal features of the ESPP and its operation. However, this summary is not a complete description of all of the provisions of the ESPP and is qualified in its entirety by the specific language of the ESPP. A copy of the ESPP as amended is provided as Appendix A to this proxy statement.

PurposeProposal 2(b). The purpose of the ESPP is to provide our employees and employees of our participating subsidiaries with an opportunity to purchase shares of our common stock through accumulated payroll deductions or other contributions that we may permit. The ESPP is intended to qualify as an employee stock purchase plan under Section 423 (“Section 423”) of the Internal Revenue Code of 1986, as amended (the “423 component”). In addition, the ESPP authorizes the grant of purchase rights that do not qualify under Section 423 pursuant to rules, procedures or sub-plans adopted by the Administrator (as defined below) designed to achieve desired tax, securities laws or other objectives (the “non-423 component”).

Authorized Shares.Initially, a maximum of 1,600,000 shares of our common stock were made available for sale under the ESPP. In addition, our ESPP provides for an Annual Share Increase that makes available an additional number of shares of our common stock under the ESPP on the first day of each fiscal year of the Company beginning in fiscal year 2015, equal to the least of:

3,500,000 shares;

1% of the outstanding shares on the last day of the immediately preceding fiscal year; or

such other amount the administrator of the ESPP determines.

As of April 1, 2016, 1,184,272 shares of our common stock remained available for issuance under the ESPP. We currently expect that approximately 590,000 shares will be purchased in our May 2016 purchase, leaving approximately 594,272 shares remaining available for issuance under the ESPP. As of April 1, 2016, the per share closing price of our common stock as quoted on the New York Stock Exchange was $6.13. If our stockholders approve the Amendment, then the maximum number of shares of our common stock that will remain available for sale under the ESPP will be approximately 4,594,272 shares.

Administration.Our board of directors or a committee appointed by our board of directors (currently the Compensation Committee is the Administrator) administers the ESPP (referred to as the “Administrator”). The Administrator may interpret the terms of the ESPP, designate separate offerings under the ESPP, designate subsidiaries and affiliates as participating in the 423 component or the non-423 component of the ESPP, determine eligibility, adjudicate all disputed claims filed under the ESPP, and establish such procedures that it deems necessary for the administration of the ESPP.

Eligibility.Generally, all employees are eligible to participate if they are employed by us, or any participating subsidiary or affiliate of ours, for customarily at least 20 hours per week and more than five months in any calendar year. However, an employee may not be granted rights to purchase stock under the ESPP if such employee:

immediately after the grant would own stock and/or hold options to purchase stock possessing 5% or more of the total combined voting power or value of all classes of our stock (or of any parent or subsidiary of ours); or

holds rights to purchase stock under all of our (or any parent or subsidiary of ours) employee stock purchase plans that accrue at a rate exceeding $25,000 worth of stock for each calendar year in which such option is outstanding at any time.

As of April 1, 2016, approximately 780 of our employees and our subsidiaries (including four executive officers) were eligible to participate in the ESPP.

Offering Periods.Our ESPP provides for consecutive, overlapping 24-month offering periods that are scheduled to start on the first trading day on or after May 21 and November 21 of each year and terminating on the last trading day on or before May 20 and November 20, approximately 24 months later. Each purchase period within an offering period will be approximately six months and will begin after one exercise date and will end with the next exercise date approximately six months later (except that the first purchase period in the offering period will begin on the first trading day of the offering period and end with the next exercise date). The Administrator may modify the terms of future offering periods, provided that no offering period may last more than 27 months. If the fair market value of our common stock on the exercise date is less than the fair market value on the first trading day of an offering period, all participants will be withdrawn from the offering period in which such exercise date occurred, as of immediately following their purchase of shares on the exercise date, and automatically will be enrolled in the immediately following offering period. Any eligible employee may participate in an offering period under the ESPP by timely submitting a properly completed subscription agreement on or before a date determined by the Administrator prior to the first day of the offering period or by following such other procedure the Administrator determines.

Contributions. Our ESPP permits participants to purchase shares of our common stock through payroll deductions (or any additional forms of payment that we may permit) of up to 15% of their eligible compensation, which includes base straight time gross earnings, but exclusive of payments for incentive compensation, bonuses, payments for overtime and shift premium, equity compensation income and other similar compensation. During a purchase period, a participant may not increase the rate of his or her contributions, but may decrease his or her rate of contributions one time to a rate of 0%.

Exercise of Purchase Right.Participants’ contributions to the ESPP are used to purchase shares on each exercise date (the last trading day of each six-month purchase period) during the offering period. The purchase price of the shares will be 85% of the lower of the fair market value of a share of our common stock on the first trading day of the applicable offering period or on the applicable exercise date. The Administrator may determine a different purchase price for future offering periods subject to applicable laws. A participant may purchase a maximum of 1,500 shares of our common stock during each purchase period. The Administrator may change the maximum number of shares of our common stock that a participant may purchase in any future offering periods.

Withdrawal. A participant may end his or her participation in the ESPP at any time and participation automatically will end upon termination of a participant’s employment with us. If a participant withdraws or is deemed to have withdrawn from the ESPP, all accrued contributions, if any, that have not yet been used to purchase shares will be returned to the participant.

Non-Transferability.A participant may not transfer contributions to the ESPP or purchase rights granted under the ESPP other than by will, the laws of descent and distribution, or, if the Administrator permits, by designation of a beneficiary.

Adjustments.In the event of certain changes in our capitalization, to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the ESPP, the Administrator will adjust the number and class of common stock that may be delivered under the ESPP, the purchase price per share and the number of shares covered by each unexercised purchase right under the ESPP, and the numerical share limits under the ESPP. In the event of our proposed dissolution or liquidation, any offering period then in progress will be shortened by setting a new exercise date and will terminate immediately before the completion of such

proposed dissolution or liquidation unless determined otherwise by the Administrator. Prior to the new exercise date, the Administrator will provide notice to participants that the exercise date has been changed to the new exercise date and that the participant’s purchase right will be exercised automatically on the new exercise date unless the participant already has withdrawn from the offering period.

Merger or Change in Control.In the event of our merger or change in control, as defined under the ESPP, a successor corporation (or its parent or subsidiary) may assume or substitute each outstanding purchase right. If any outstanding purchase rights are not assumed or substituted, the offering period to which such purchase rights relate will be shortened by setting a new exercise date on which the offering period will end. The new exercise date will occur before the date of the proposed merger or change in control. The Administrator will notify each participant that the exercise date has been changed and that the participant’s purchase right will be exercised automatically on the new exercise date unless before such date the participant has withdrawn from the offering period.

Amendment; Termination.Our ESPP will terminate automatically in 2034, unless we terminate it sooner. The Administrator has the authority to amend, suspend, or terminate our ESPP at any time and for any reason, subject to the terms of the ESPP.

Number of Shares Purchased by Certain Individuals and Groups

Participation in the ESPP is voluntary and dependent on each eligible employee’s election to participate and his or her determination as to the level of contributions to be made. In addition, the number of shares that may be purchased under the ESPP generally is determined, in part, by the price of a share of our common stock on the first trading day of each offering period and the last trading day of the applicable purchase period. Accordingly, the actual number of shares of our common stock that may be purchased by any individual is not determinable in advance. The following table sets forth (i) the number of shares of our common stock that were purchased during fiscal year 2015 under the ESPP, and (ii) the weighted average per share purchase price paid for such shares, for each of our named executive officers, all current executive officers as a group, all non- employee directors as a group, and all other employees who participated in the ESPP as a group:

Name and Position or Group | | Number of Shares Purchased (#) | | | Weighted Average Purchase Price Per Share ($) | |

Lee Chen(1) Chief Executive Officer | | | — | | | | — | |

Sanjay Kapoor Vice President of Global Marketing | | | — | | | | — | |

Ray Smets Vice President of Worldwide Sales | | | 2,775 | | | $ | 3.451 | |

| All current executive officers as a group | | | 11,775 | | | $ | 3.451 | |

| All current directors who are not executive officers as a group(1) | | | — | | | | — | |

| All employees (including all current officers who are not executive officers, as a group) | | | 1,093,240 | | | $ | 3.5643 | |

| (1) | These individuals are not eligible to participate in the ESPP. |

U.S. Federal Income Tax Consequences

The following paragraphs are intended as a summary of the U.S. federal income tax consequences to U.S. taxpayers and to the Company of the purchase of shares of our common stock under the ESPP. This summary does not attempt to describe all possible U.S. federal tax consequences or other tax consequences of such participation or address any individual’s particular circumstances. In addition, it does not describe any state, local or nonU.S. tax consequences.

The ESPP is intended to be an employee stock purchase plan within the meaning of Section 423. Under an employee stock purchase plan which so qualifies, no taxable income will be recognized by a participant, and no deductions will be allowable to the Company upon either the grant or the exercise of purchase rights. Taxable income will not be recognized until there is a sale or other disposition of the shares acquired under the ESPP or in the event the participant should die while still owning the purchased shares.

If the participant sells or otherwise disposes of the purchased shares within two years after the start date of the offering period in which the shares were acquired, or within one year after the actual purchase date of those shares, then the participant generally will recognize ordinary income in the year of sale or disposition equal to the amount by which the fair market value of the shares on the purchase date exceeded the purchase price paid for those shares, and the Company will be entitled to an income tax deduction for the taxable year in which such disposition occurs equal in amount to such excess. The amount of this ordinary income will be added to the participant’s basis in the shares, and any resulting gain or loss recognized upon the sale or disposition will be a capital gain or loss. If the shares have been held for more than one year since the date of purchase, the gain or loss will be long-term.

If the participant sells or disposes of the purchased shares more than two years after the start date of the offering period in which the shares were acquired and more than one year after the purchase date of those shares, then the participant generally will recognize ordinary income in the year of sale or disposition equal to the lesser of (i) the amount by which the fair market value of the shares on the sale or disposition date exceeded the purchase price paid for those shares, or (ii) 15 percent of the fair market value of the shares on the start date of that offering period. Any additional gain upon the sale or disposition will be taxed as a longterm capital gain. Alternatively, if the fair market value of the shares on the date of the sale or disposition is less than the purchase price, there will be no ordinary income and any loss recognized will be a long-term capital loss. The Company will not be entitled to an income tax deduction with respect to such disposition.

If the participant still owns the purchased shares at the time of death, the lesser of (i) the amount by which the fair market value of the shares on the date of death exceeds the purchase price or (ii) 15 percent of the fair market value of the shares on the start date of the offering period in which those shares were acquired will constitute ordinary income in the year of death.

Summary

Our board of directors believes that it is in the best interests of the Company and our stockholders to continue to provide employees with the opportunity to acquire an ownership interest in the Company under the ESPP and thereby encourage them to remain in our service and more closely align their interests with those of our stockholders.

Vote Required

The approval of the ESPP Amendment requires the affirmative vote of a majority of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon. Abstentions will have the effect of a vote against the proposal and broker non-votes will have no effect.the same effect as votes against these proposals.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL

AMENDMENT AND RESTATEMENT OF AN

AMENDMENT TO OUR 2014 EMPLOYEE STOCK PURCHASE PLAN TO REMOVE THE

AUTOMATIC ANNUAL SHARE INCREASE THEREUNDER COMPANY’S AMENDED

AND INCREASE THE NUMBERRESTATED CERTIFICATE OF INCORPORATION.